Rising shareholder activism in Asia acts as ‘feedback loop’ for governments

Government decisions are mirroring the themes that shareholder activists are raising.

Regulatory changes in Asia-Pacific are making activism more attractive to investors, according to the “Shareholder Activism in Asia 2025” report published by Diligent Market Intelligence.

The report found that Asia remains to be a “growing hotbed for activism,” with more than 200 firms in the region targeted with demands on a yearly basis. In Japan, 108 campaigns were advanced by shareholder activists in 2024; in South Korea, 78; in Hong Kong, 16; and in Singapore, 15.

Based on Diligent’s Activism dataset as of the end of the first quarter of 2025, the top activist in Asia over the past 15 months is Tokyo-based Strategic Capital. Leading the ranking – which also looked at the success rate for resolved public demands – the hedge fund targeted 12 companies.

Other impactful activists include South Korea’s Align Partners Capital Management; Oasis Management Company in Hong Kong; and Dalton Investments, a US-headquartered firm with offices in East Asia.

Diligent Market Intelligence Editor-in-Chief Josh Black noted: “Over 200 Asia-based companies a year have found themselves subject to activist demands in recent times, a trend that continues to be fuelled by governments prioritising corporate governance reform and activists bolstering their teams to capitalise on emerging opportunities.”

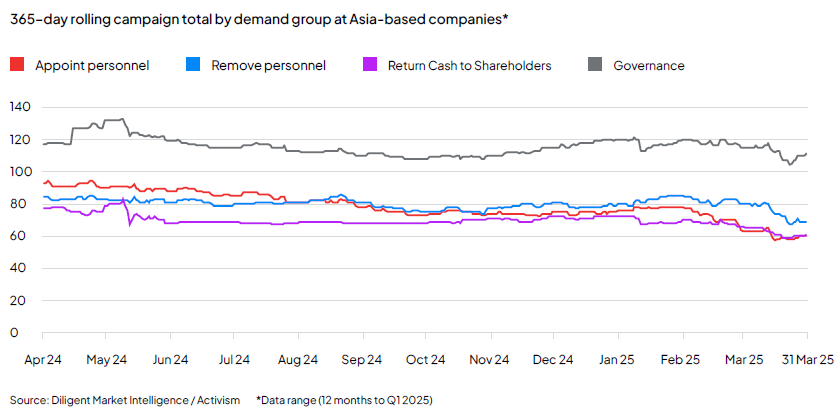

High on the agenda for shareholder activists – who Black pointed out are increasingly using a combination of private and public channels to exert pressure on organisations – are governance reforms.

“Shareholder activism has gained significant traction across Asian markets in recent years, particularly in Japan, South Korea, and Taiwan,” Alliance Advisors Managing Directors Julie Rhee and Celine Feng said in their joint insights as part of the report. “Government-backed reforms aimed at fostering shareholder-friendly corporate governance, coupled with persistent valuation gaps, have contributed to this growing trend.

“The longstanding assumption that domestic institutional and retail investors will align their votes with management is being challenged, making it more essential than ever for companies to understand shareholder sentiment.”

Alliance Advisors highlighted that changes in the regulatory landscape in the Asia-Pacific region have given shareholder activism a further boost.

Rhee and Feng stated: “In South Korea, for instance, the Korean Stewardship Code now makes it much harder for asset managers to vote against proposals that promote shareholder value. That is echoed by other transparency pushes, from sharper fiduciary policies to online voting.”

Additionally, according to the managing directors, activism has also been growing amongst retail investors. An example of this trend is the office worker who led a successful campaign to change the voting system at a large discount store chain in South Korea.

“Taiwan has witnessed similar shifts, and the region’s regulators are ever-more involved in making shareholder activism easier,” they went on to say. “Beyond electronic voting and the like, firms are increasingly expected to appoint independent directors and offer training to executives.

“The Taiwan Stock Exchange, too, is making it simpler for retail investors to get involved, in January removing restrictions on qualified investors.”

For Black, the growth of shareholder activism in Asia indicates a broader change in the way organisations and shareholders engage with each other, as well as the improved sophistication of activist investors. He said shareholders are now more adept at navigating the complex regulatory environments and cultural nuances of Asian markets.

The message to Asia’s governments

So, what are these trends telling governments in the region?

In an interview, Black told GovMedia: “Overall, we’re seeing investor expectations rise across the region, with activist demands placing an increased emphasis on governance standards, capital efficiency, and board accountability. That may indicate to Asian governments that their reforms are succeeding and encourage them to go further in the pursuit of higher growth and economic returns.”

Black cited the revised Corporate Governance and Stewardship Codes in Japan, which has also seen a reformed Tokyo Stock Exchange; South Korea’s updated stewardship guidelines and the country’s Corporate Value-Up Programme; as well as changes to the Code of Corporate Governance and SGX listing rules in Singapore.

He added that the initiatives collectively point to a regional shift towards market environments that are more transparent and investor-friendly. Black went on to highlight that despite disagreements about the pace or details of change, the consensus on the need for governance reforms is increasingly bipartisan.

In Black’s view, Asian governments’ decisions – even whilst broad-based – are mirroring the same themes that shareholder activists are shining a light on, in boardrooms.

“Whilst shareholder activism may not directly shape government policy, it acts like a feedback loop, exposing governance weaknesses or structural gaps that might otherwise go unaddressed,” he explained in the GovMedia interview.

“Governments may not act solely because of activism. However, institutional investors are important stakeholders and advocates on the need to boost valuations or attract capital to their markets and can demonstrate their viewpoints either in direct communication with governments or by supporting activists.”

Black acknowledged that whilst activism is not the main driver of reform, it does strengthen the case for change. He told GovMedia: “Governments and regulators are clearly paying attention to these trends, and regulatory changes are increasingly being designed to foster constructive dialogue and better protect shareholder interests.”

According to Diligent’s data, 203 Asia-based firms were targeted by activist demands in 2024. The corresponding figure in 2021 was 134, whilst 2022 saw an increase to 189. In 2023, the number stood at 221.