Reforms offer better growth prospects to top securities firms in South Korea

Opportunities include revenue diversification via Investment Management Account.

The likes of Mirae Asset Securities and Korea Investment & Securities are facing growth opportunities amidst market reforms in South Korea, including new Investment Management Account (IMA) business approvals and proposed changes to the Capital Market Act Enforcement Decree. The latter is aimed at enhancing risk-based capital requirements as well as risk controls.

"Fitch believes these developments will enhance the competitive positions of large, well-capitalised securities firms, while supporting long-term sector growth and investor confidence," the credit rating agency commented.

"IMAs allow consolidated management of customer deposits and distribution of associated profits. Notably, IMAs have fixed maturities and guarantee the return of their principal at maturity, with expected yields higher than current cash management products, which have shorter tenors and invest in lower-risk short-term debt instruments."

In Fitch's view, the new business approvals, alongside stricter capital and operational requirements, are set to facilitate "notable expansion" for already established firms in terms of their business scope.

It said: "Fitch believes new growth opportunities from IMA-related business and the broader regulatory push to enhance securities companies' capacity to offer new investment products will underpin a gradual increase in revenue diversification and earnings stability over the medium to long term, provided effective risk controls are maintained."

Given the requirements, however, it is perceived that the IMA line of business may not be as accessible to the majority of industry players at this point.

"Regulatory barriers to entry for the IMA segment appear high, which may limit the number of entities able to operate in it," Fitch pointed out. "The FSC's (Financial Services Commission) proposed changes to the Capital Market Act Enforcement Decree, released on 16 July, raise capital requirements for securities firms seeking to expand into new business lines.

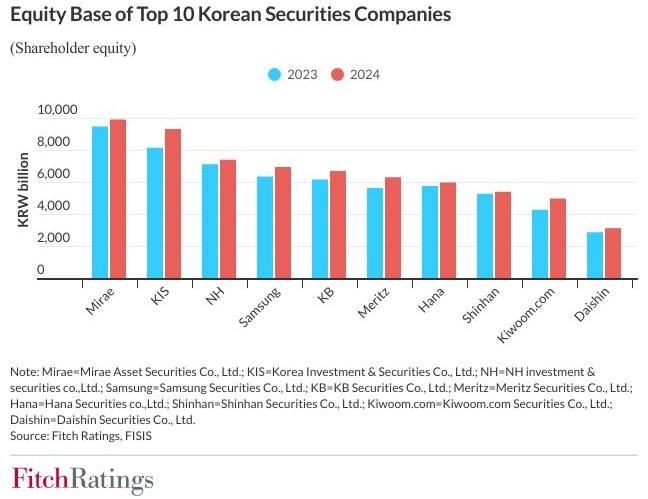

"IMA eligibility requires ₩8t (about $6b) in equity capital and two years' experience in the promissory note business. IMAs will be legally defined as principal-guaranteed products, although investors will retain early redemption rights, potentially incurring losses."

As part of the proposed regulations, securities firms will also have to set aside at least 5% of IMA principal to serve as loss reserves.

The credit rating agency stated: "With these high barriers to entry, we think that the launch of IMAs and general regulatory trend to allow more new product offerings may contribute to the concentration of asset-management market share amongst established players in the medium term.

"Amongst established firms, those with stronger capital resources should benefit disproportionately, as they would be better positioned to expand into new product areas. Currently, we believe only Mirae Asset Securities and Korea Investment & Securities meet the requirements for doing IMA business."

Open for consultation through August 2025, the proposed changes to the Capital Market Act Enforcement Decree include phasing in a reduction of the proportion of funds raised through promissory notes and IMAs that can be allocated to the real estate sector.

"This aims to reduce real estate concentration risk and redirect capital towards small and medium-sized enterprises, venture companies, venture capital firms, and new technology businesses," Fitch elaborated.

"We view this as part of the authorities' efforts to enhance the efficiency of capital allocation, to support local economic growth. However, increased capital allocation to these innovative and early-stage industries could raise asset quality risk for investment products if accompanying regulatory risk controls prove ineffective."

Further consolidation in the securities space in South Korea is seen as a possible outcome of the reforms.