Government investment funds key to China's industrial plan: S&P Global

Country expected to lean on private equity to fuel industrial upgrading.

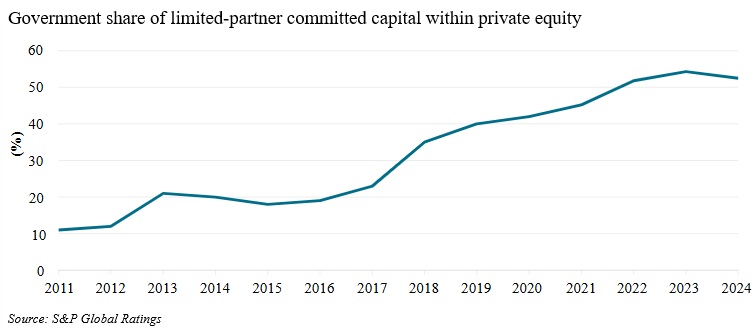

Already a "dominant force" in Chinese private equity and venture capital, government-backed investment funds in China are expected to be instrumental in realising the country's industrial goals, according to S&P Global Ratings.

In its "China Governments To Take $2 Trillion Bet On Industrial Upgrading" report, the credit rating agency noted: "Government investment funds will play a central role in China's industrial ambitions. We estimate the programme has an ambitious target funding of about US$2 trillion-equivalent. Local governments can handle their commitments with minimal fiscal impact."

Citing industry sources, S&P Global said government-related money, including cash from state-owned enterprises, comprised nearly 90% of all Chinese private equity as of the end of 2024. It was also highlighted that established private equity firms and investment holding companies are helping the government identify good investments.

"We view the funds as an adjunct to industrial planning by the Chinese government," S&P Global reported. "It channels money into risky enterprises that may have difficulty attracting private seed capital.

"Government backing gives room for the funds to align with national policy goals. Purely private funds would simply prioritise returns. Government funds can tolerate low returns for years, allowing them to invest in initiatives that may not yield immediate profits but may be important to the country's development, we assume."

Based on the credit rating agency's analysis, governments in China will potentially take a decade to fully raise and invest their target capital.

S&P Global stated: "Currently the funds just oversee about renminbi (RMB) 4.5 trillion (about US$630 billion) of assets.

"The funds will likely prioritise high-tech emerging enterprises that produce high-value-added goods; this will be consistent with China's push to upgrade its manufacturing sector and to become more technologically self-reliant."

It added: "This new model will be equity/venture capital focused, which is a better fit with the long-term, high-risk type of investing the funds will undertake, in our view."

In terms of investment focus, the local government in Beijing is said to be investing in advanced manufacturing and intelligent equipment, artificial intelligence (AI), new materials, robotics, information technology, green energy, medicine and health, commercial aerospace, and drone delivery services.

The government investment funds in Shenzhen, meanwhile, are reportedly into the likes of AI, electric vehicles, and new materials. In Shanghai, semiconductors, biomedicine, and AI are amongst the areas being invested in, while Guangzhou funds are focused on semiconductors, new energy, biomedicine and health, advanced manufacturing, and information technology.

"We believe local governments hope to eventually generate fiscal revenue from their stakes, primarily through dividend collection and equity appreciation," S&P Global declared. "This would reduce their reliance on land sales. However, this outcome may take decades, and these government investment funds are merely an initial step."

It went on to say: "Provincial governments and affluent cities will be the biggest early backers of the funds, we assume. We see these local governments as generally able to manage such spending; their investments will not likely lead to materially higher government debt. They have ample fiscal capacity to fund these initiatives, and flexibility to adjust investments as needed in case of revenue shocks.

"For instance, over the past decade, tier-one cities such as Beijing and Shenzhen have invested between RMB100 billion and RMB200 billion each in such funds, with annual investments averaging less than 3% of their total budget expenditure."

S&P Global estimates that China's annual contribution to the local funds will represent less than 2% of the total government expenditure in the coming years.