HK’s government-related entities seek growth despite property slump

S&P Global Ratings examines reliance on property income amidst weak business conditions.

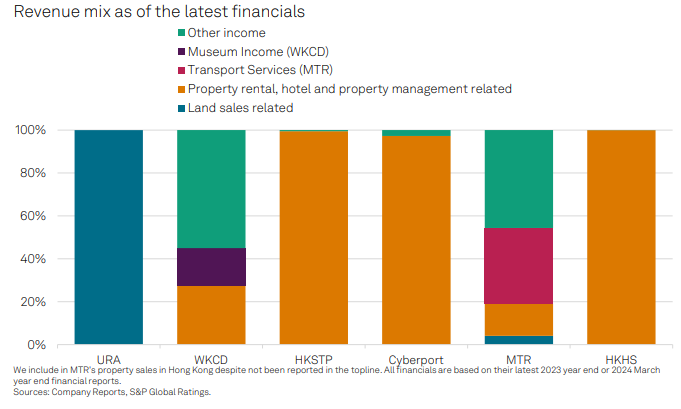

Even amidst Hong Kong’s property slump, analysts at S&P Global Ratings believe that property income will continue to be essential to various government-related entities (GREs) in the city. These include the Urban Renewal Authority (URA), Hong Kong Cyberport Management Company Limited (Cyberport), MTR Corporation Limited, and Hong Kong Science & Technology Parks Corporation (HKSTP).

According to the credit rating agency, which also looked at the Hong Kong Housing Society (HKHS) and West Kowloon Cultural District Authority (WKCD), “property-related income is key” for these GREs, most of which are fully government-owned. “While their property income varies, all the highlighted entities rely on it,” said Ricky Tsang, director and lead analyst at S&P Global Ratings.

MTR, for instance, uses both Hong Kong transportation income and land sales as part of its “Rail-Plus-Property” model. Similarly, the URA supports urban renewal by using revenue from land sales, while HKHS – an independent entity not owned by the government – provides affordable homes through its income from residential development and rental earnings from public housing.

HKSTP and Cyberport, meanwhile, house high-tech firms and startups on their premises and offer seed funding and guidance to entrepreneurs. Below is a breakdown of the GREs’ revenue sources, as illustrated by S&P Global Ratings in the agency's “Hong Kong's Property-Linked GREs Aim For Growth” report.

In their analysis, Tsang said: “URA and MTR have large property development exposure and are impacted by the current cyclical downturn. These two companies have historically contributed to roughly 25% of private residential land supply in Hong Kong over the past 10 years.

“With a weakening property market, URA's margins have turned negative over the past two years, due to losses incurred on land tenders. MTR's cash flow from operations also halved in 2024 from the peak in 2021 partly due to reduced land sales and withdrawn tenders.”

MTR, which benefits from land premium waivers from its land tender revenue, is a publicly listed entity that is 75% owned by the government.

As for the other GREs – all of which enjoy various levels of ongoing government support such as tax exemptions or capital injections – it was noted that weak business conditions in Hong Kong have led to losses.

“Cyberport did not generate profit over the past years, in part due to the cost of its public mission, which includes financial assistance to startups,” Tsang said. “WKCD also had not generated a profit in recent years due to COVID effects (lockdowns and reduced gatherings in public spaces) and the high operating costs of running exhibitions and museums.

“HKHS has been in deficit over the past three years due to ongoing operating expenses, and larger investment properties/property inventory write-downs. HKSTP is in general more stable than others, given the essential solidity of its rental business. Occupancy of the Science Park premises have been about 90% over the past two years.”

To support the coming capital expenditure cycle, some of the GREs have initiated more debt financing, according to S&P Global Ratings. URA, for instance, raised $12 billion from the bond market last year to replenish funding for Hong Kong’s urban redevelopment, while a loan signed by HKHS carries the same price tag.

“Among unrated GREs or public entities, we expect their debt leverage to rise,” the lead analyst said. “Most have already seen rising total debt, given increased external funding. For HKHS, which has not reported its 2024 results yet, its use of debt should increase from nil in 2023 as it signed a syndicated loan in September 2024.”

Of the abovementioned GREs, only MTR and URA are rated. It’s these two organisations that Tsang’s camp believes “would almost certainly receive extraordinary support” from the Hong Kong government in a stress scenario.

“Even as the entities’ property-related income weakens amidst a property downturn in the city, these companies still have to manage sizable capital expenditure and new investments; many will turn to external funding,” Tsang said.

“We believe the Hong Kong government will provide timely support in the case of financial stress; the degree of support will likely vary, depending on the importance of each entity to the government.”