Government-related entities in Asia enjoy high levels of state support

Stronger backing seen in the region compared to counterparts outside of Asia.

State support for government-related entities (GREs) in Asia is “virtually certain,” according to Fitch Ratings analysis. The credit rating agency, which rates around 500 public GREs globally, found that Asian governments are highly incentivised to support GREs.

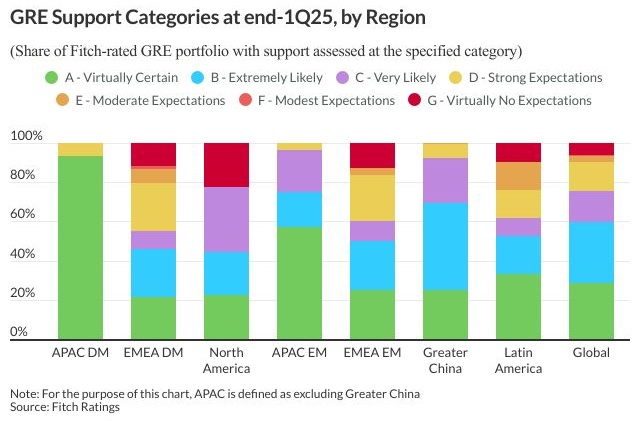

“The share of government-related entities benefitting from the three highest categories of support – meaning that support is virtually certain, or extremely or very likely – is higher in Asia than in other parts of the world,” said Fitch Ratings, which assigns support categories based on its assessments of a government’s responsibility and incentives to provide GRE backing.

Fitch Ratings reported: “The proportion of our rated GRE portfolio in Asia, assessed as being within the top-three categories for support, stood at 93% as of end-1Q25 (first quarter of 2025), significantly higher than the share of 76% for the global GRE portfolio.

“The relatively high level of support assumed for GREs in Asia in part reflects the fact that many governments in the region have historically favoured state-led development, giving state-linked firms important social and economic policy roles.”

According to the rating agency, GREs typically hold strategic importance to governments as part of their significant parent-subsidiary relationships. Fitch Ratings uses a matrix of assessment scores to assign an overall support score to these rated entities, which are concentrated in greater China and in developed markets (DMs) in the Europe, Middle East, and Africa region.

Explaining its analysis, Fitch Ratings said: “Almost all Asian GREs were assessed as ‘strong’ or ‘very strong’ with regard to the degree of decision-making control and oversight that supporting governments exercise over them. Around 69% were scored at ‘very strong’, compared with 45% for GREs in other parts of the world.

“We believe supporting governments have a ‘strong’ or ‘very strong’ incentive to provide support to 95% of rated Asian GREs, based on their importance as a tool for policy implementation. GREs in Asia also have an extensive record of precedent on support provision.”

It went on to note an important factor in the high levels of support enjoyed by Asian GREs.

“Another key differentiator between GREs in Asia, and those elsewhere in the world, is the incentive to provide support based on contagion risk,” Fitch Ratings pointed out. “This assesses the risk that the supporting government (or its other GREs) could face impaired access to capital if the rated entity defaults.

“Fitch assesses this factor as ‘very strong’ for 35% of rated entities in Asia, and ‘strong’ for a further 64%. The equivalent figures for the rest of the world are 15% and 43%, respectively.”

The rating agency added that the share of rated GREs in emerging markets (EMs) benefitting from the top-three categories for support was at 82%, exceeding the corresponding 62% in DMs.