Local and regional governments in China, India top indebtedness in emerging markets

Gross borrowing by emerging markets LRGs forecast to reach new high in 2025.

Despite their operating surpluses, local and regional governments (LRGs) in emerging markets (EMs) are expected to see increased debt issuance over the next two years, according to credit rating agency S&P Global Ratings.

“We project that gross borrowing by EM LRGs globally will hit a new peak of $1.5t in 2025, with Chinese LRGs accounting for $1.3t of that amount,” S&P Global Ratings analysts said. “Most of that borrowing by Chinese LRGs reflects their issuance of special-purpose bonds, as those LRGs conduct debt swap transactions to bring hidden debt onto official balance sheets.

“Pre-pandemic borrowing seems further away for most EM LRGs. Outside of China and India, we expect EM LRGs’ gross and net borrowing to remain mostly flat, with EM LRGs in Latin America – that is, LRGs in Brazil, Argentina, and Mexico – being the most indebted. Following them will be EM LRGs in EMEA – primarily African EM LRGs – and EM LRGs in the Asia-Pacific.”

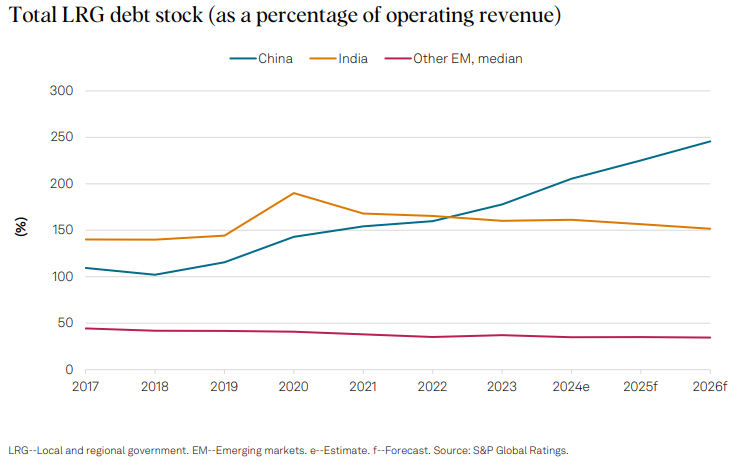

It was noted in the credit rating agency’s “Borrowing Will Rise on Funding Needs and Capex” report that the median ratio of debt to operating revenue for LRGs in other EMs is estimated to be at 35% for the 2024-2026 period. Meanwhile, the predicted averages for Chinese and Indian LRGs stand at over 200% and 160%, respectively, as shown below.

Explaining the discrepancy, S&P Global Ratings analysts stated: “Lower debt burdens at many EM LRGs compared with the debt burdens at their developed-market counterparts reflect weaker institutionality, weaker financial management, small local markets, and limits on market access.

“EM LRGs tend to run larger operating surpluses to help finance capex (capital expenditures) and amortisation. That said, large after-capex deficits at EM LRGs are largely driven by LRGs in China and India. Elsewhere, many balances after capex that are close to zero reflect unmet investment needs.”

In Asia-Pacific – with the exception of Pakistan (near 60%) – LRG debt burdens as a percentage of operating revenue fall below 20%. Moving forward, overall borrowing by LRGs in emerging markets is expected to see an uptick.

“EM LRG borrowing overall will trend upward, driven by Chinese and Indian LRGs, while borrowing by other EM and frontier-market LRGs should moderate,” analysts said. “Among EM LRGs, those in Latin America are the next-largest borrowers in US dollar terms.

“While Brazilian LRGs’ debt burdens remain high given the indexed composition of their legacy debt with the central government, they don’t tap the markets. Mexican LRGs’ borrowing is in the form of domestic currency bank loans.”

They added: “Argentine LRGs are among the few EM LRGs globally that aim to borrow in the global capital markets, and do so in US dollars. A key question in the next several years is whether or not they’ll gain market access to repay forthcoming amortisations.

“We expect the 2024 reform in Poland and the new EU (European Union) cycle to support additional borrowing capacity for Polish LRGs as they take on local currency bank loans.”

In terms of operating balances, the estimated median as a percentage of operating revenue is 16% for 2024-2026.

“In the past, that’s almost double the figures that developed-market LRGs have posted,” S&P Global Ratings reported. “Less fluid access to diverse funding options forces EM LRGs to rely more on their own source funding or savings.

“Some LRGs lean to conservative budgeting because of uncertainty about grants and transfers. That said, operating balances above 20% of operating revenue for LRGs in China, Czech Republic, Nigeria, Philippines, South Africa, and Thailand weigh heavily on the EM fiscal indicators.”